ALDI

ALDI

How might we better understand the end-to-end customer experience of the grocery shopping journey and identify opportunities for improvement and differentiation?

Skills Used

Discovery Research

Primary Research — Understanding Customer’s Grocery shopping Habits

As a research team, our objective for this project was to highlight the customer voice to help provide justification for the overall strategy presented to the client. In order to do this, we decided to conduct 20 interviews with a diverse group of participants. The goal of these interviews was to gain a better understanding of customer’s grocery shopping habits and their perception of ALDI if applicable. Before we could start the interview process, we had to create an interview protocol to help guide the conversation and make sure we were getting the information we needed to accomplish our goal. The protocol was broken into different topics that included things such as; general attitudes towards grocery shopping, grocery retailers shopped, ALDI specific questions and a deep dive into the grocery shopping process including planning, purchasing and after shopping. Prior to the hour long interview, each participant completed a homework assignment where they were asked to “step outside their normal mode of shopping and experience a different channel to purchase their groceries” specifically shopping at ALDI. Participants were asked to document this experience with images and were told that they would be discussing their experience in-depth during the interview. In order to recruit participants for our interviews we worked with a lady named Beth Ann from a company called New England Focus Group. We created a screener that helped us recruit a variety of participants by asking questions about things like occupation, technology competency, grocery shopping habits and other demographical questions. Our screener also outlined for Beth Ann the different demographical splits we were hoping to achieve with our participant pool. For example, we were aiming for a good mix across demographics such as gender, ethnicity, age, household composition, household income, educational level and geographical location and type. Once Beth Ann had recruited our participants based on our specifications it was time to start the interviewing process. Conducting 20 1-hour long interviews in a time span of two weeks is a very time consuming and enlightening process. During this time I acted as the primary note taker for the interviews while Katharina and Animesh took turns moderating the interviews. I learned a ton about interviewing best practices and loved hearing from all different types of people about their grocery shopping experiences.

DebriefinG USER Interviews

After Animesh, Katharina and I had completed two interviews we decided to start the debriefing process. By debriefing the first two interviews together we were able to better understand what information we wanted to pull out of each interview. After completing the first two debriefs together we split up to debrief the remaining 18 interviews. For each interview we filled out a debrief card that included information such as key takeaways, why ALDI, grocery shopping channels used, pain points, top priorities when grocery shopping, digital wants/needs and memorable quotes. An example of these filled out debrief cards can be seen to the right. The rest of the debrief cards can be seen on this MURAL board.

Examples of the interview debrief cards we filled out for each participant

Uncovering High Level Themes

While we were debriefing the individual participant interviews we would keep track of observations that seemed to be coming up across the interviews. We kept track of these similarities very informally and unstructured to start. This can be seen in the image to the right. Once we had debriefed all of the interviews and pulled out all of the common themes we went through and started putting similar observations together into higher level themes. After categorizing the themes we cleaned up the language which resulted in the final six high level themes uncovered from our research. These six themes can be seen below.

Work-in-progress themes uncovered during interview debriefing (CLICK TO SEE FULL PICTURE)

Persona Creation

While debriefing our interviews and uncovering underlying themes we also started to think about how to categorize different research participants into persona types. We started the persona creation process by placing participants on a 2x2 that had an axis of utilitarian shopper to enjoys the shopping process and the other axis of savings focused versus convenience focused. This exercise gave us a better understanding of the key drivers that would differentiate our personas. These key drivers were price, convenience and the grocery shopping experience. It then became apparent that we would have three different personas each prioritizing a different key driver. This resulted in three final personas: the savings focused shopper, the utilitarian shopper and the exploratory shopper. Once we had our three personas we started to think about the different motivations, needs and pain points for each persona and placed our research participants into their appropriate persona. We also created one other visual to categorize our participants based on their role in the “ALDI-verse”.

The 2x2 that we used to start categorizing participants

Understanding the “ALDI-verse”

Presenting Findings internally and to the client

Once we got to the point where we had a concrete list of high level themes and had identified our personas we presented our findings to our internal team. During this presentation we got feedback from the internal team about what to prioritize during our share out with the client. For example, in conversations that the internal team had with the client they learned that there was a big focus on curbside coming from the client side, so it was important for us to highlight any findings around curbside and limit any findings relating to the in-store experience. After this initial sharing with the internal team we honed our findings and took the feedback into consideration which resulted in the presentation we shared with the client.

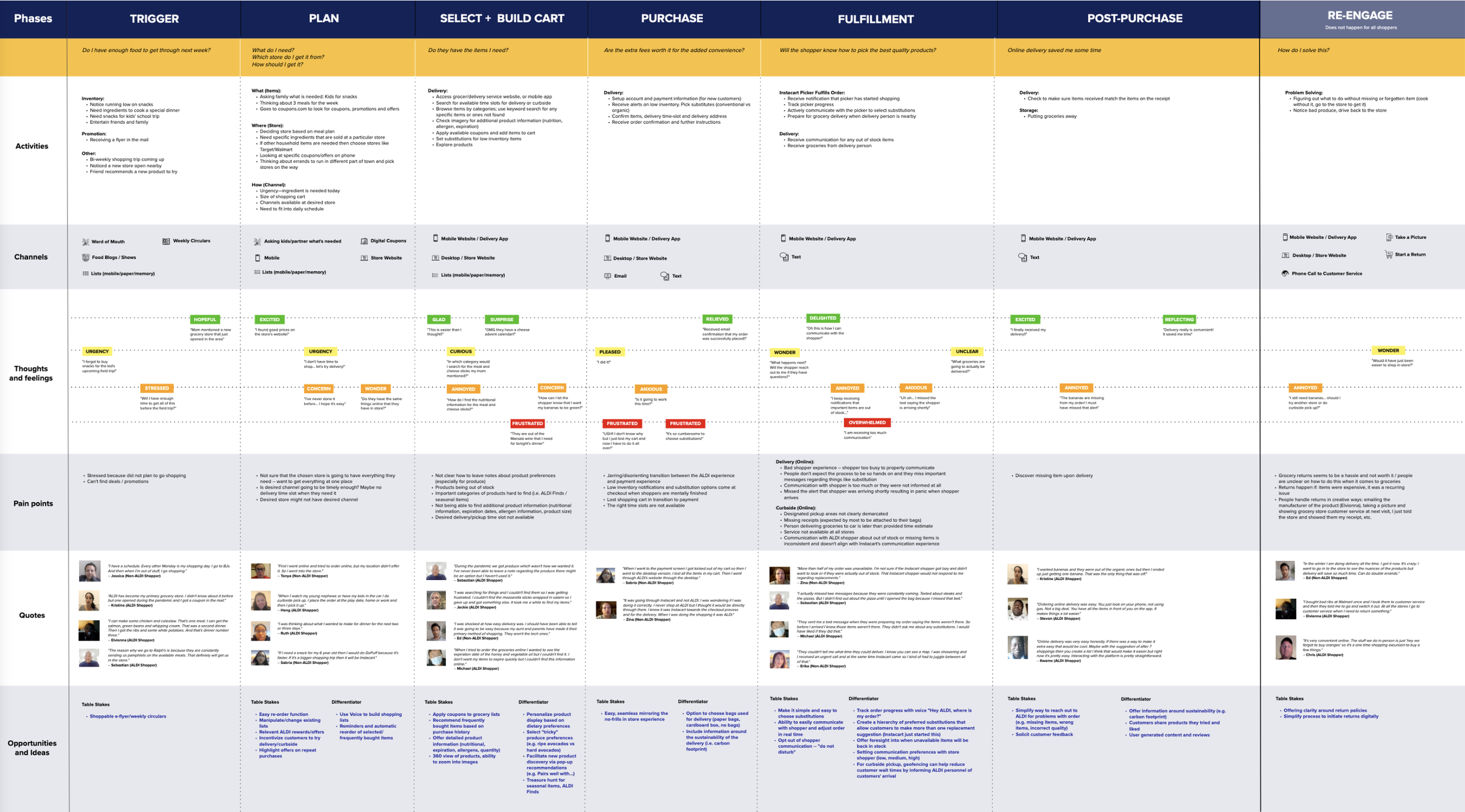

Journey Map Creation

Finally it was time to create the last part of our final deliverable, the journey map. This journey map acted as a way to view all of the major findings from our research in one spot. Together Animesh, Katharina and I came up with the stages of the journey (the columns) which were: trigger, plan, select and build cart, purchase, fulfillment, post purchase and re-engage. Next we came up with swim lanes (the rows) which were: activities, channels, thoughts and feelings, pain points, quotes and opportunities/ideas. Once we had determined the rows and columns we made a rough draft of the journey map together. This rough draft is the picture on the left below. As a group we came up with a story line that we wanted the journey to follow which helped us identify things like activities and thoughts and feelings for the different phases of the journey. After having a rough draft that we were happy with we increased the fidelity by using a journey map template from a previous project.

First draft journey map

Final journey map

Final Deliverable

Our final deliverable for this project was a MURAL board that neatly displayed our key themes, personas and final journey map. That MURAL board can be found here. Additionally, the internal team used many of our customer research findings in their final pitch deck to the client. Some of the slides containing our findings and work can be seen below. In the end, the client was really happy with the work that this team accomplished and I was very happy to be a part of that success.

Feedback received from Associate Managing Director

Key Takeaways

Interviewing best practices

Pause to ask your co-moderator if they have questions in the middle of the interview and at the end

Do not interject with your own stories or answer their personal questions to you — if they ask questions redirect the question back to them

Do a debrief after the first interview if possible to make any necessary changes to the protocol before the other interviews

During the interview make sure to keep referring back to things they said to make sure you understood correctly

Always ask at the end of the interview if there was anything they thought you were going to ask but didn’t

If there is an interviewee no show and the client happens to be on the call make sure to provide updates to the client and take it as an opportunity to ask if there are any other questions the client wants asked during the interviews

It is important to set realistic expectations of what work will get done — other members of the team might expect deliverables that are not necessarily attainable on their timeline so it is important to vocalize more realistic expectations to the team

For this type of strategy work it is important to understand the bigger picture and pull out themes/quotes/findings that support this

Effective communication between all parts of the larger internal team is very important

Contributions

I would like to say a special thank you to Katharina Licht, Animesh Tohan and the rest of the Publicis Sapient internal team that I worked with on this project.